CMS Charity Accounts 2022

Since the Chelmsford Muslim Society are claiming ownership of the Hamptons Islamic Centre, and have indicated to the City Council, that they operate the venue, their charity accounts now become a matter of public interest to this campaign. The full annual return for the charity is available in the public domain HERE

A big turnover in Trustees

So in 2022, the number of trustees rose to 14, one of the new trustees has since resigned, leaving the current number at a bakers dozen. Changing that number of trustees normally indicates governance issues. The Charity Governance Code suggests a board of at least five but no more than twelve trustees is typically considered good practice.

great fundraising but massively increased costs

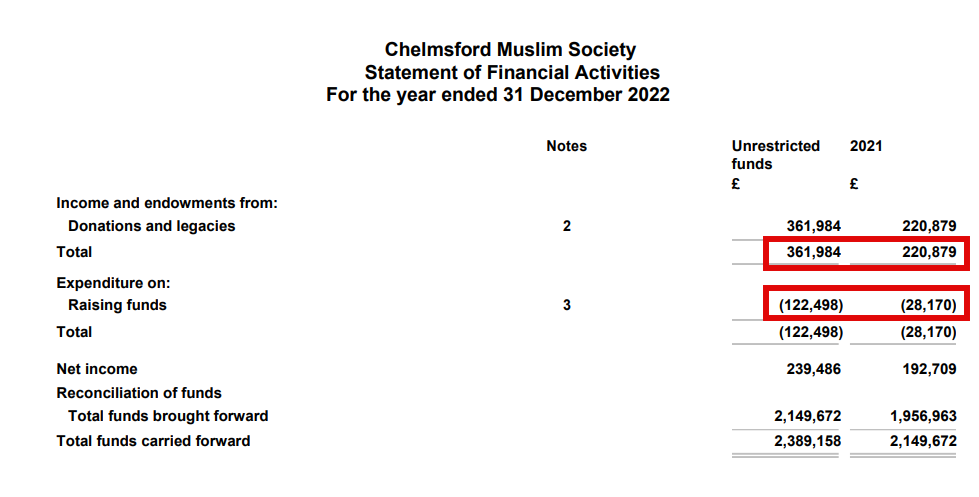

While donations increased impressively from £221K to £382k (up by 63%), the associated expenditure on raising funds has risen by an eye-popping 435%.

And that’s something that worshippers should challenge the trustees on, and something that the Charity Commission may look at.

Where’s the income from the makarim academy

And the image above tells another tale, why is there no income declared for:

Charitable activities

Other trading activities

The Makarim Academy opened in September 2022, and the CMS Newsletter from that year claimed they had “145 students are enrolled, we have 19 teachers and 21 classes”.

The Makarim Academy is not listed as a stand alone business or registered as a charity, and on the Makarim Academy website, it clearly states “Makarim Academy is the new name for Islamic education under Chelmsford Muslim Society”

Based on the figure of £600 per student (half payable up front), where is the £43,500 income that would be generated for the 2022 return period. And why are the 19 teachers not listed as employees.

Delivering charitable activities outside of the United Kingdom

In September/October 2022, CMS generously collected money for a project providing aid for Pakistan and Bangladesh.

Charities are required to declare any grants made to:

individuals

other charities

other organisations that are not charities

Why is there no mention or declaration of this charitable activity, and why is there no declaration of the amount collected and donated, even if it was passed on as a grant to another charity ?

Other areas of concern

Some other observations:

The legal fees for 2022 were £14k, presumably the cost of the failed lawful development application

Governance costs ( including legal fees) rose from £2.7k to £23.4k

The valuation of the investment/property is declared as £2.35 million which is considerably higher than the valuation used in the Hamptons Sport and Leisure Ltd business accounts for 2022 - £1.87 million

Now, we want state that we are not accusing the Chelmsford Muslim Society of any wrongdoing, we are merely making observations as members of the public, who should be able to have complete confidence in the clarity of any declaration or return made by a registered charity.